ATR-Forex.com Advanced Trading Resources |

|

|

|

技術分析:匯市K線圖型態組合K線圖,燭台圖,陰陽線圖(Candlestick Charts) - 一種首先在日本開始使用的圖表方法,這種圖表採用蠟燭模樣的圖形來顯示市場價格的變動。在K線圖中,一個矩形(稱為實體或燭身)代表開盤價與收盤價之間的差別。一條直線代表最高價與最低價之間的幅度,稱為影線。如果收盤價高於開盤價,實體為白色、綠色、或不被填充;如果開盤價高於收盤價,實體為紅色、黑色、或被填滿。

看跌吞沒、空頭吞噬(Bearish Engulfing) - 此K線圖型態描繪在一個上升的趨勢中,一根陽線之後,出現一根實體更長的陰線。看跌吞沒表明價格變動可能向下逆轉。

看漲吞沒、多頭吞噬、破腳穿頭(Bullish Engulfing) - 此K線圖型態描繪在一個下降的趨勢中,一根陰線之後,出現一根實體更長的陽線。看漲吞沒表明價格變動可能向上逆轉。

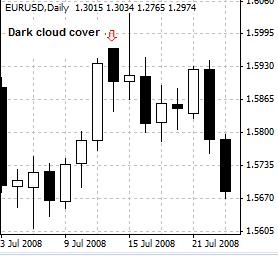

烏雲蓋頂(Dark Cloud) - 此K線圖型態描繪在上升的趨勢中,一根K線高開、但收盤價卻低於前一根K線的中位數;也就是說,在一組陽線之後,出現一根陰線。烏雲蓋頂被視為看跌反轉信號。

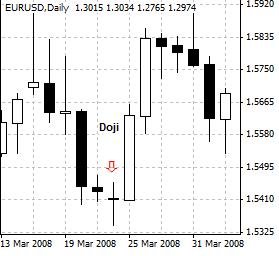

十字線(Doji)- 只有上下影線,沒有身體的K線圖型態,表明開盤後價格先後上揚、下跌,但收盤價與開盤價相等。

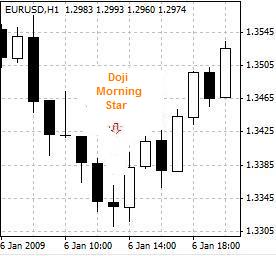

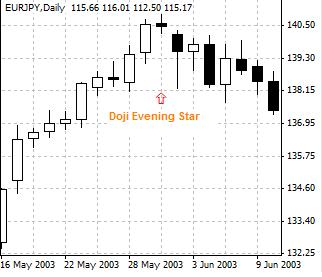

十字線星(Doji Stars) - 此K線圖型態包括一個跳空的十字線。其中又分十字線晨星和十字線夜星。

十字線夜星(Evening Doji Stars) - 由三根線組成的看跌反轉K線圖型態。第一根線是陽線,第二根線是高於第一根線的十字線,第三根線是陰線,其收盤價低於第一根陽線實體(燭身)的中位數。又見十字線晨星。

夜星、昏星(Evening Stars) - 由三根線組成的看跌反轉K線圖型態。第一根線是陽線,第二根線實體較短、但是高於第一根線,第三根線是陰線,其收盤價低於第一根陽線實體(燭身)的中位數。與晨星相反。

錘子型態(Hammer) - 錘子型態為一根下影線很長、實體較短的K線,出現在下降趨勢中。一般情況下,為看漲反轉信號。

吊人型態(Hanging Man) - 吊人型態為一根下影線很長、實體較短的K線,出現在上升趨勢中。一般情況下,為看跌反轉信號。吊人型態表面上看起來像錘子型態,但它出現在上升趨勢中,而錘子型態則出現在下降趨勢中。

包孕線(Harami) - 包孕線型態描繪的是後一根K線較短的實體,完全包含在前一根K線較長的實體中,而且這兩根K線顏色相反,一陽一陰。包孕線型態為趨勢反轉型態。

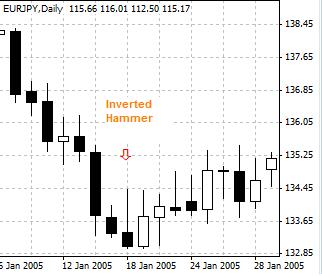

倒錘(Inverted Hammer) - 倒錘型態為一根上影線很長、實體較短的K線,出現在下降趨勢中。一般情況下,為看漲反轉信號。

十字線晨星(Morning Doji Star|) - 由三根線組成的看漲反轉K線圖型態。第一根線是陰線,第二根線是低於第一根線的十字線,第三根線是陽線,其收盤價高於第一根陰線實體(燭身)的中位數。與十字線夜星相反。

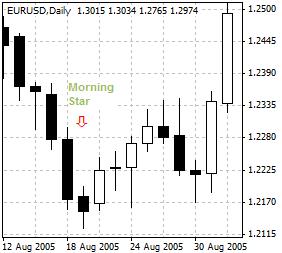

晨星(Morning Star) - 由三根線組成的看漲反轉K線圖型態。第一根線是陰線,第二根線實體較短、但是低於第一根線,第三根線是陽線,其收盤價高於第一根陽線實體(燭身)的中位數。與夜星相反。

上沖線(Piercing Line) - 一種下降趨勢中的看漲反轉K線圖型態。此型態包括兩根K線,前一根K線是長陰線,後一根K線為跳空低開的長陽線;後一根K線的收盤價高於前一根K線實體(燭身)的中位數。

流星、射擊之星(Shooting Star) - 此型態為一根實體較短、上影線很長的K線。它出現在上升趨勢中,一般為看跌的警示信號。

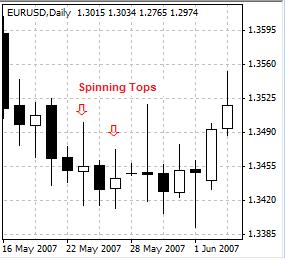

紡紗頂(Spinning Tops) - 此型態為一根實體較短、上下影線較長的K線。一般情況下,表明價格將橫向整理。

星型(Stars) - 星型K線圖型態由一根燭身很短的K線與前一根K線組成,後一根K線的收盤價不在前一根K線實體的價格範圍之內。其中又分晨星和夜(昏)星。

|